Brokers for intraday trading

(PipsHunt) At the very first, Intraday trading is a type of trading in which a trader takes positions and closes them on the same day by making profits on short-term stock market swings.

Intra traders are also called Day traders. Beginners in day trading often Imagine what it would be like to trade in the market, what are the best brokers for intraday trading, and are there any drawbacks! According to me, LiteFinance is one of the best brokers for trading.

In this blog, I tried to clarify some basic concepts of intraday trading and the best broker for them to choose.

Table of Content

- How Does Intraday Trading Work?

- How Do Day/Intraday Traders Use Online Brokers?

- What Are the Risks of Intraday Trading?

- Top 12 Brokers for intraday trading in 2022:

- Fidelity

- TradeStation

- TD Ameritrade

- Interactive Brokers

- Cobra

- E*TRADE

- Lightspeed Trading

- Zacks Trade

- Merrill Edge

- Webull

- Charles Schwab

- Firstrade

How does intraday trading work?

Regarding long-term investors who strive to purchase low and sell high, many day traders prefer to sell short. Which indicates they sell high and purchase cheap in order to profit from price declines.

Unlike buy-and-hold investors, who try to profit from market volatility by maintaining positions for the long term, day traders try to profit from it on a daily basis by entering and exiting positions to take advantage of modest price variations. Because Intraday traders rely on intraday price changes and quick order execution, the instruments they trade are often large volume (with good liquidity) and volatile. Back Top⤴

How Do Day/Intraday Traders Use Online Brokers?

Day traders can either place trades individually, using a chart as a guide, or set up an automatic system to place orders on their behalf. Fundamental data is not essential, but the ability to keep track of price quotes, price volatility, liquidity, trading volume, and breaking news is crucial to day trading success.

Brokers who charge per share are frequently recommended by day traders (rather than per trade). Traders also require real-time reports on margin and purchasing power. By modifying the size of trades and turning off the trade confirmation screen, each broker ranked here allows their day-trading customers to enter orders rapidly.

Usually, traders looked for brokers who let them make several orders at the same time, choose which trading venue would process the order, and set trading defaults.

Back Top⤴

| 🎩Top THREE Award-Winning Brokers in 2022🎩 LiteFinance | IC Markets | Avatrade |

What Are the Risks of Intraday Trading?

Day trading can be profitable, but it comes with drawbacks, just like any other sort of investment. One of the most major risks for retail day traders is that they are up against a crowded field of professionals with the necessary resources (speed, trading cash, technology, and software) to win.

It might be difficult for retail traders to profit on a consistent basis without a level playing field.

Another significant danger is that day traders frequently utilize leverage to start positions, which means they risk losing more money than they invest. Short transactions, in which the trader sells "high" in the hopes of covering "low" at a profit, carry essentially infinite risk because prices can continue to rise indefinitely.

Other major danger is being undercapitalized. Traders with insufficient trading capital might soon deplete their accounts, putting an end to their day trading careers. Furthermore, traders who use anything other than risk money to finance their accounts risk losing more than their trading accounts. Back Top⤴

Best Intraday Trading Broker 2022

Here are the most active trader platforms for intraday trading:

.png)

-

Fidelity

Fidelity.com and Active Trader Pro are two trading systems offered by Fidelity. Fidelity provides powerful screeners based on ten years of historical data, combining research and strategy-testing techniques. For intraday traders Fidelity is best for order execution. Back Top⤴

-

TradeStation

Day traders can develop, test, monitor, and automate their customized trading strategies for stocks, options, and futures using TradeStation's direct market access, automatic trade execution, and tools. They can use TradeStation Simulator to try out new investing methods without risking any money.

The OptionStation Pro platform is available for free to option investors. The mobile app users can create custom watch lists and observe charts and trends without creating an account by using the preview mode. Back Top⤴

-

TD Ameritrade

TD Ameritrade has two major trading platforms, each with a mobile version.Which adds a great opportunity to monitor the market for day traders. TDAmeritrade.com contains almost everything an ordinary investor needs to locate, study, filter, and trade stocks, ETFs, bonds, and CDs.

The free platform includes screeners, a configurable landing page, and the broker's GainsKeep feature, which may help you monitor capital gains and losses. Back Top⤴

-

Interactive Brokers

Interactive Broker is quick and contains both basic and unique features, such as real-time monitoring, notifications, watchlists, and a configurable account dashboard. Intraday traders may submit multileg option orders and compare up to five options strategies at once using the options strategy lab.

In addition, Interactive Brokers provides a volatility lab, sophisticated charting, heat maps of sector and stock symbol performance, paper trading, and a mutual fund replication, which assists users in identifying ETFs that match the performance of a certain mutual fund while charging lower costs. Back Top⤴

-

Cobra

Intraday traders use short selling as a primary technique. Cobra Trading is designed to meet the demands of professional day traders in the stock and options markets. Through its Venom Trading business, they also provide futures trading. Cobra Trading provides a diverse set of platforms, competitive commission rates, and dependable customer service. Back Top⤴

-

E*TRADE

E*TRADE offers two trading platforms: Power E*TRADE and E*TRADE Web. Both are flexible and accessible to all clients, with no trade activity or balance requirements.

E*TRADE Web provides free streaming market data, real-time quotations, live market commentary, analyst research, stock screeners, and other services. Power E*TRADE provides real-time data, over 100 technical studies, more than 30 drawing tools, simplified trade tickets, configurable options chain views, and trading ladders. Back Top⤴

-

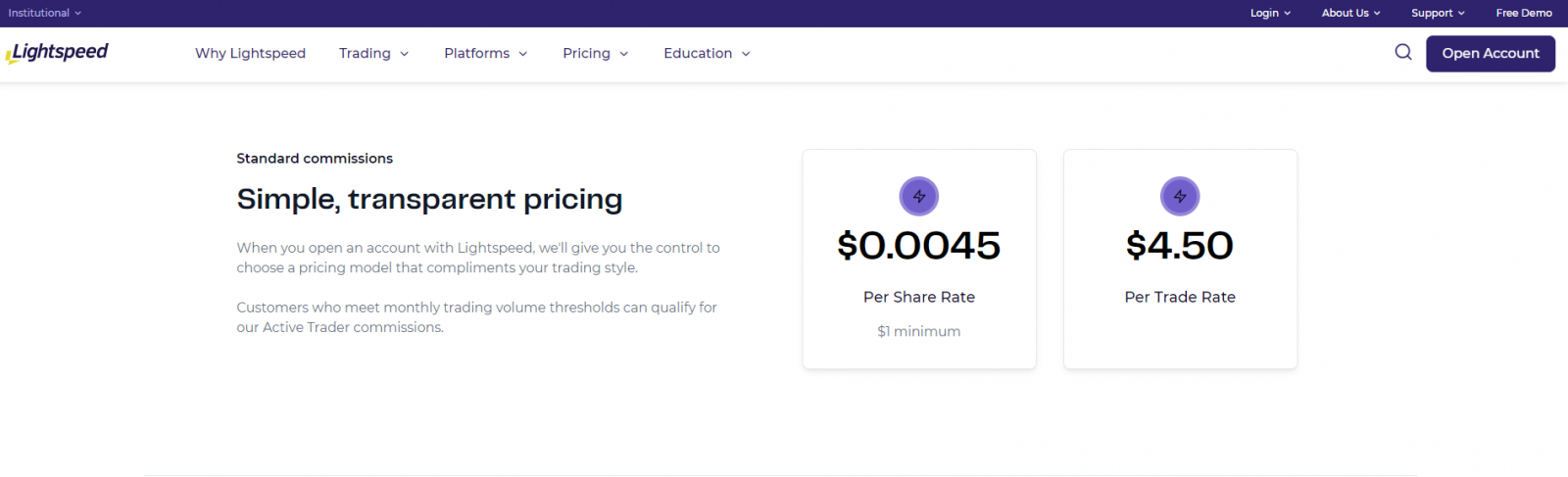

Lightspeed Trading

The Lightspeed Trader platform has been simplified to focus on data and order execution, with no extraneous bells and whistles. The platform has ultra-low latency, is extremely reliable, and is highly configurable. Lightspeed Trading's technology and features are intended to allow traders to exploit market opportunities as quickly as possible.

Scanners are an important tool for day traders who want to uncover volatile stocks or equities that are near crucial price levels. Lightscan, Lightspeed's scanner, provides unique analysis capabilities such as net change (the change from the beginning of the period to the latest price) and H/L. (showing whether the stock is currently at the high or low of the period). Back Top⤴

-

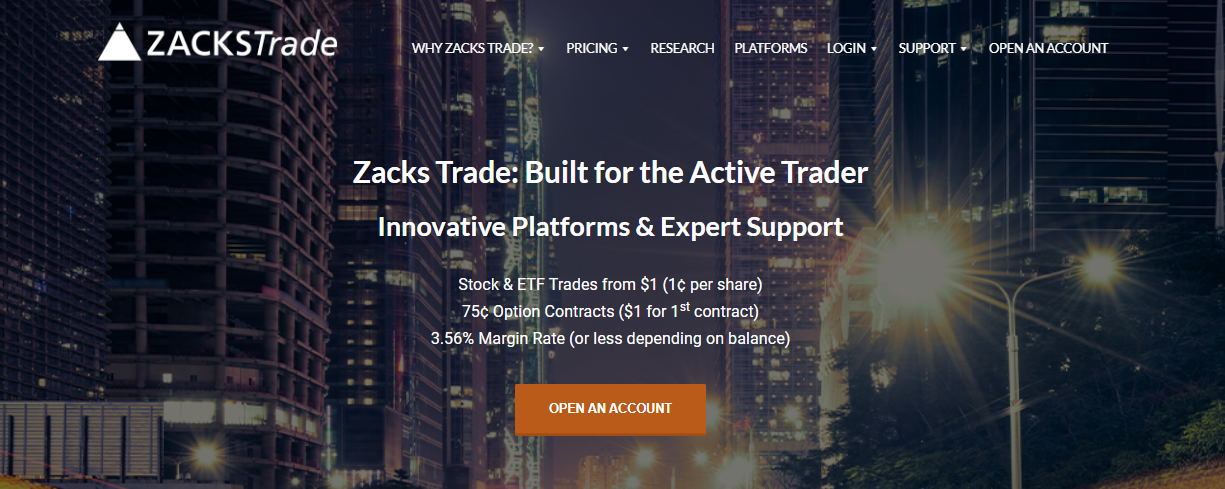

Zacks Trade

Zacks provides three complementary trading platforms. The downloadable Zacks Trade Pro allows traders to personalize the layout to meet their own needs, and it includes custom charting, more than 120 technical indicators, and an Options Strategy Lab to assist them in evaluating prospective options trades.

The web-based Zacks Trader provides interactive charts, live market data, and other features. Back Top⤴

-

Merrill Edge

Merrill Edge provides internet trading as well as an active trader platform called Merrill Edge MarketPro. The website provides a number of screeners to help you swiftly filter through stocks, mutual funds, ETFs, and bonds. There's also a "fast trade" tool that allows you to trade stocks and ETFs from almost any page on the internet. Back Top⤴

-

Webull

Webull is more of a no-cost broker than a low-cost broker. Webull, in addition to commission-free stock and ETF trading, provides free trading on US-listed options. There are no minimum account balances, and the margin rates are competitive.

Day traders may be frustrated by the restricted asset selection, but fixed income is likely to be the only one overlooked in a multi-asset trading arrangement. This asset constraint may be overcome for certain traders by the introduction of cryptocurrency trading.

Furthermore, considering that it is entirely free, Webull's trading platform is pretty powerful. Back Top⤴

-

Charles Schwab

Schwab has numerous comprehensive trading platforms that are all free and available to all trading services clients. Its main product is StreetSmart Edge, a customizable platform available as downloaded software or online via cloud-based technologies.

It also features a suite of options trading applications known as StreetSmart Central. Finally, the broker provides mobile trading via the Schwab or StreetSmart Mobile applications. Back Top⤴

-

Firstrade

Firstrade Navigator allows the trader to examine their positions and balances, as well as trade-in accounts, all from a single screen. Firstrade's comprehensive screener can help traders narrow down the investing options by categories including high-yielding quality companies, large-cap growth stocks, "bargain basement" small-cap funds, and dozens more.

Options Wizard provides an extensive analysis of prospective losses and earnings from options trading, as well as over 40 complicated options methods. Back Top⤴

Here are a few FAQs about Intraday trading brokers:

Q. Is intraday trading profitable?

A. For those with a steady hand, intraday trading may be a source of revenue. It's all about making little gains through a variety of trades throughout the day.

Q. Which is the best broker for trading in the world?

A. Generally, Fidelity Investments is the overall best Intraday trading broker. It is known for its Low Cost.

Q. Which app is best for international trading?

A. Webull app is the best to assist in investing in International stocks.

Q: What is the best trading platform in Europe?

A: Fidelity Investments is also the best broker in Europe. Rather than a large number of traders choose Interactive Brokers. Back Top⤴

Bottom Line

All these are the best intraday trading broker in 2022 for beginners and professionals. These brokers offer intraday trading calls, tips, and research recommendations, but only brokers cannot define winning.